By Paul Nicholson

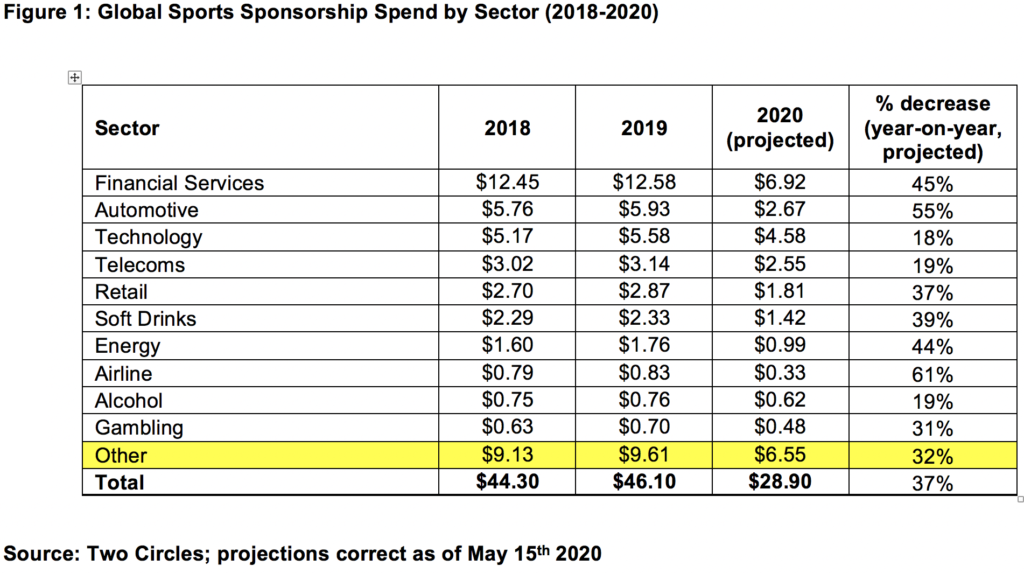

May 18 – The global sports sponsorship spend looks set to fall by $17.2 billion, from $46.1 billion in 2019 to $28.9 billion (37% year-on-year decrease) in 2020 as the result of the Covid-19 pandemic.

The projections, by international sports marketing agency Two Circles, forecast a 45% year-on-year decrease in spend ($5.7 billion) from companies in the Financial Services sector. They will now spend a projected $6.9 billion on sports sponsorship having accounted in 2019 for a $12.6 billion sponsorship spend – 27.3% of total spend.

Automotive, Energy and Airlines – sectors hit hard by the pandemic and also ranked in the top 10 by sports sponsorship spend in 2019 – will also significantly scale back spend. Automotive, the second biggest spender in 2019, will contribute $2.7 billion in 2020, down by $5.9 billion (55%) on 2019.

The Two Circles figures come from the agency’s Sponsorship Engine, a machine-learning-powered data platform, that measures the impact, engagement and value digital channels deliver sports sponsors.

“The Covid-19 pandemic has seen most new sponsorship agreements put on hold, and many existing agreements will be ended as a result of companies implementing major cost-cutting measures or going out of business. Sponsors will also be given ‘makegood’ sponsorship collateral and cash rebates due to the postponement and cancellation of live sport, significantly reducing their financial outlay in 2020,” said the Two Circles report. The figures exclude any spend on partnership activation.

Gareth Balch, Two Circles CEO, said: “As a marketing platform to reach passionate and emotionally-engaged audiences at-scale in brand-safe environments, sports sponsorship is unrivalled. However, with live sport halted globally since March, the value that sports properties have been able to deliver brand partners has been limited, with cost-cutting in sectors that invest heavily in sponsorship also presenting a significant challenge in signing new deals.”

Not all is doom and gloom as Balch believes the sponsorship market will innovate and that a sustained period of spectator-less sport will be an opportunity for sports that develop their digital marketing platforms for the post-pandemic world.

“Though every corner of sport is hurting, we remain certain that sport’s economy will thrive in the long-term, and when the impending recession bottoms-out, all sectors will rely on the best marketing platforms available to grow their businesses. The sports properties that use this period to invest in their sponsorship propositions, moving away in particular from analogue-led logo exposure to digitally-driven, tangible audience engagement, will be those that thrive most post-Covid-19,” said Balch.

Contact the writer of this story at moc.l1713539930labto1713539930ofdlr1713539930owedi1713539930sni@n1713539930osloh1713539930cin.l1713539930uap1713539930