December 3 – City Football Group and soft drinks brand Red Bull have blazed a trail in the area of multi-club football ownership, and in the pandemic era of no fans and an uncertain broadcast and sponsorship market, opportunities to buy professional teams have never been greater.

A new report by the KPMG Football Business team ask whether the growth of multi-club owners and the business opportunities that an expanded club portfolio brings are the future.

While the report finds plenty of good reasons to encorage club buyers, it warns that “complex ownership structures also pose special risks and should only be pursued and implemented if they provide the best approach for achieving the goals of the shareholders.”

Essentially the message is that investors looking to build club portfolios should do deals based on business reasons and objectives, and not football ones.

The Football Benchmark team reckon that while in 2017 UEFA reported that there were at least 26 first division clubs across Europe involved in cross-ownership, that number will be significantly higher today with improved club commercialisation and broadcast revenues to professional football attracting a wider spectrum of investors and private equity interest.

They point out however, that “buying and running a top football club has mainly become the privilege of private investors or organisations with outstanding financial capabilities, whereas these individuals or entities are also in a position to be able to establish portfolios with a wide range of assets.”

They add that the obvious but often overlooked “increasing polarisation within professional football has resulted in financial disparity between a handful of ‘elite’ clubs and other members of the football landscape, enabling powerful clubs to extend their own business operations through the acquisition of other smaller clubs of strategic fit.”

In other words the market is not an exactly a free trade area where the same opportunities exist for everyone.

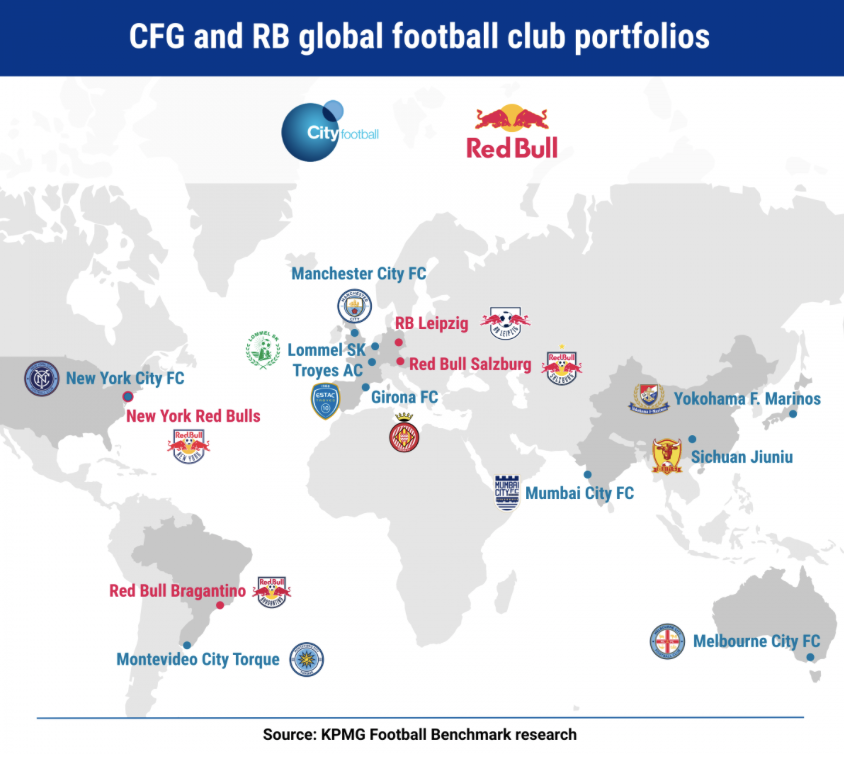

The report looks at the different business models of City Football Group, built around flagship club Manchester City, and Red Bull which considers investment into football as a global marketing tool for its brand, with its clubs deliberately located in key markets.

There are merits in both models but the core business opportunity identified comes in the ability

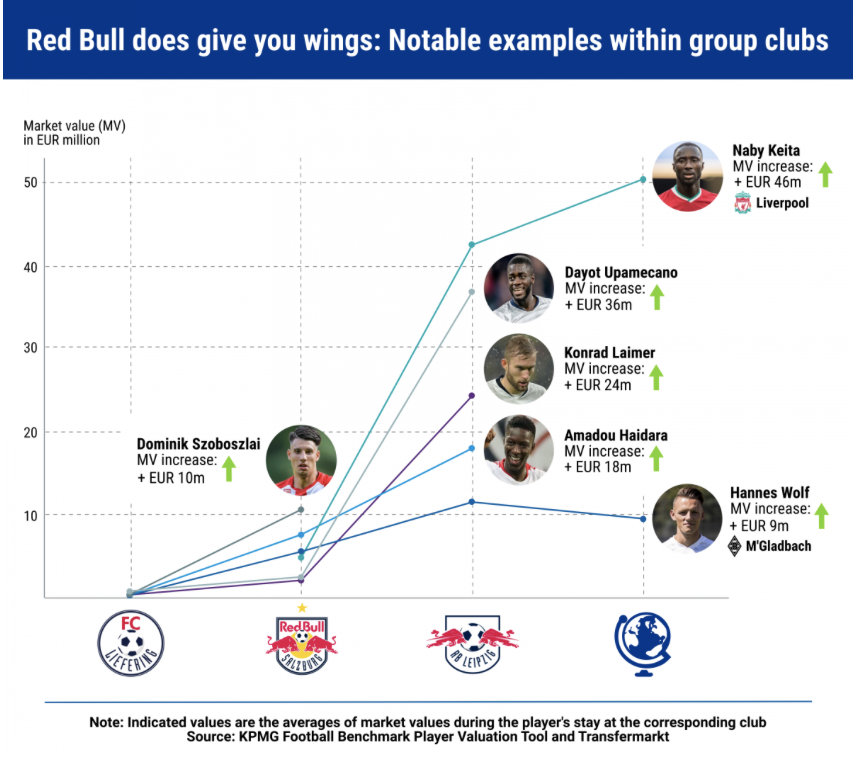

Looking at the business reasons for multi-club ownership the clearest opportunity to gain a competitive business advantage is in on-field performance and player development in particular.

“As there is an ever-increasing fierce competition for accessing and developing top talent globally, clubs are looking for alternative solutions. One dominant approach is vertical integration, meaning that some club owners, mostly from the biggest competitions, are acquiring satellite clubs in smaller leagues with the aim of securing playing time for their young talents, who would otherwise be blocked from getting first team opportunities,” say KPMG.

“Once they reach their full potential, they can either return to the parent club or find permanent positions in- or outside the group. Examples include English Premier League side Leicester City’s owners, the Srivaddhanaprabha family, which also controls OH Leuven, currently in Belgium’s top division; or French sides AS Monaco’s and Lille’s satellite association with Belgian clubs Cercle Brugge, and Royal Excel Mouscron, respectively. The latter deal, struck last summer, triggered the transfer of over 10 young players from LOSC to Mouscron. Lille’s owner, Luxembourg businessman Gerard Lopez, also expects that Mouscron’s famous academy will create more young local talents to play later, not only for Mouscron but Lille as well, or to be sold to other top clubs at a premium.”

See the full report at https://footballbenchmark.com/library/multi_club_ownerships_is_it_the_future_of_football

Contact the writer of this story at moc.l1713086345labto1713086345ofdlr1713086345owedi1713086345sni@n1713086345osloh1713086345cin.l1713086345uap1713086345