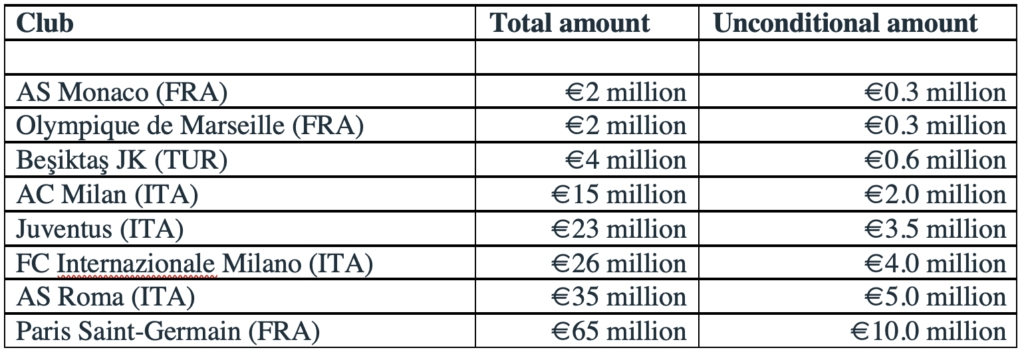

September 4 – UEFA has hammered eight of Europe’s biggest clubs with fines totalling €172 million. Big spending Paris St Germain were hardest hit with fines of €65 million.

PSG are followed by four Serie A clubs on the financial bad boys list, with Roma, Inter Milan, Juventus and AC Milan being issued fines of €35m, €26m, €23m and €15m respectively.

The clubs, who were joined by Besiktas, Monaco and Olympique de Marseilles, all fell foul of UEFA’s financial breakeven requirement and have all agreed to pay their fines, circumventing any repeat of the Manchester City case that UEFA embarrassingly lost on the club’s appeal to the Court of Arbitration for sport.

The fines were issued by UEFA’s Club Financial Control Body (CFCB) First Chamber, chaired by former US Soccer Federation president Sunil Gulati.

All eight of the fined clubs compete in European clubs competition and their fines will be withheld from any revenues they earn from participating in UEFA club competitions. If that doesn’t cover their sanction then they will have to pay directly.

However, the clubs only have to pay 15% in full (€26 million of the combined amount) with UEFA saying “the remaining balance of €146 million (85%) is conditional depending on these clubs’ compliance with the targets stated in the respective settlement agreement.”

UEFA said the settlement agreement framework is identical for all clubs who had the choice of opting for a three-year or four-year agreement.

The three-year settlement agreement forces the clubs to comply with the new football earning rule during the 2025/26 season with undertakings to reach intermediate annual targets.

The four 4-year settlement – chosen by AS Roma and Inter Milan – gives one additional season to comply with the football earnings rule but restricts the signing of new players from the 2022/23 season.

UEFA is transitioning its own club financial rules from the old ‘Club licensing and Financial Fair Play Regulations’ that came into force in 2018, to the ‘Club Licensing and Financial Sustainability’ regulations that will be phased in from financial year 2023.

The aim is to get the clubs to “fully comply with the stability requirements (i.e. the football earnings rule)”.

Critics of the what has been viewed in most quarters as the ineffectiveness of the financial fair play rules and cash rich clubs that have showed blatant disregard for them, will be disappointed that the fines have not been more punitive and immediate.

A fine of 15% of €65 million for PSG, to be taken from their pretty much guaranteed European club revenues of close to €100 million, is unlikely to bother the cash-rich Qatari owners.

The analysis that led to the sanctions covered the financial years 2018, 2019, 2020, 2021 and 2022, with financial years 2020 and 2021 which were subject to the Covid emergency measures, being assessed as a single period.

Essentially the clubs that have been serial breakers of the financial regulations would appear to have got away with it. Four of those clubs have won their national championships in the years of rule breaking covered, qualifying them for the big money European club competitions.

UEFA said that there were a further 19 clubs that took part in the 2021/22 UEFA club competitions – including Barcelona, Chelsea and Manchester City – who only met breakeven requirements because they were saved either by historical financial performance or, perhaps ironically, by the application of the COVID-19 emergency measures.

“The CFCB First Chamber also observed that another 19 clubs that took part in the 2021/22 UEFA club competitions, namely Borussia Dortmund (GER), Chelsea FC (ENG), FC Barcelona (ESP), FC Basel 1893 (SUI), 1.FC Union Berlin (GER), Fenerbahçe SK (TUR), Feyenoord (NED), Leicester City FC (ENG), Manchester City FC (ENG), Olympique Lyonnais (FRA), Rangers (SCO), Real Betis Balompié (ESP), Royal Antwerp FC (BEL), Sevilla FC (ESP), SS Lazio (ITA), SSC Napoli (ITA), Trabzonspor AŞ (TUR), VFL Wolfsburg (GER) and West Ham United FC (ENG), were able to technically fulfil the break-even requirement thanks to the application of the COVID-19 emergency measures and/or because they benefited from historical positive break-even results,” said UEFA.

The European governing body warned that the clubs “that as from financial year 2023 these exceptional COVID deductions and consideration of historical financial results will no longer be possible. These clubs were further asked for additional financial information and will be monitored closely in the upcoming period.”

Contact the writer of this story at moc.l1714035029labto1714035029ofdlr1714035029owedi1714035029sni@n1714035029osloh1714035029cin.l1714035029uap1714035029