By Paul Nicholson

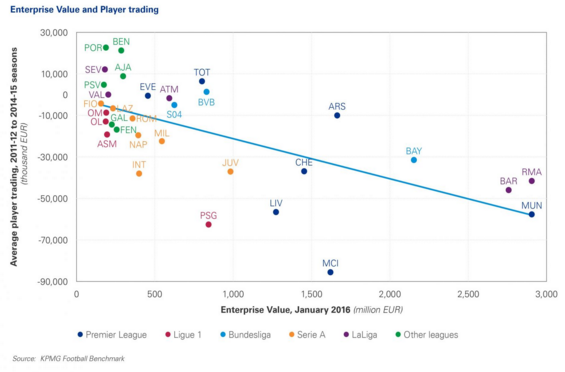

October 28 – The accepted football wisdom is that if you throw big money at buying your playing squad then you will win. The reality of this rule of thumb is different and as a rule is challenged by a Football Benchmark analysis that examines the average net player trading activity, between the 2011-12 and 2014-15 seasons, of top European football clubs.

Their analysis, based on clubs ranked by their own Enterprise Values (EV) in their club valuation report, highlights Sevilla, Borussia Dortmund and Atlético de Madrid as “proof of how sporting results can coexist with sustainable management.”

“Sevilla FC, with a strategy based on efficient re-investment of the profits from players’ disposal, have been able to establish themselves as real contenders after Barcelona FC and the Madrid pair of Real and Atlético. While Sevilla’s domestic success may have been limited, they have gained international recognition, winning three successive UEFA Europe Leagues,” says the report.

“Atlético’s stream of high-profile player sales have yielded regular transfer fee income, evidenced by an average net player trading activity (negative by only €1.7 million) that is impressive for a club able to win LaLiga, the UEFA Europa League and reach two UEFA Champions League finals – in an era dominated by Barcelona FC and Real Madrid CF. In Germany, competing with the superpower of FC Bayern Munich, Borussia Dortmund won the Bundesliga (2012) and reached the UEFA Champions League final (2013) during the analysed period, recording a positive average net player trading activity of €1.4 million.”

These three clubs may prove to be the exception to the rule, but they do pose questions for club owners and their management’s recruitment.

However, spend, spend, spend is still clearly the easiest route to take for owners – and presumably preferred because it is generally their own money they are spending. The report finds that “25% of the 32 clubs under review recorded positive average net player trading activity between 2011-12 and 2014-15.”

The report “unsurprisingly” finds that the Top 10 clubs by Enterprise Value are also, with the exception of Arsenal, those at the bottom of average net player trading activity. Arsenal’s spot has been occupied by FC Internazionale Milano, a club that have invested significantly in recent years to recapture past glories.

As befits an organisation with a powerful accountancy and analysis background with parent company KPMG, the Football Benchmark analysis shows a much broader picture and the true meaning and impact financially of player trading to the club’s accounts and financial position. The methodology is robust and it is worth understanding their accounting definition of player trading to understand the club strategies.

“Player trading activity is defined as the result of different accounting items, profit/loss on disposal of players’ registrations and amortisation usually account for most of the player trading activity figure. The Profit/Loss on disposal represents the difference between the income related to the sale of players and the net book value of the player at the moment of the disposal. The Amortisation outlines the capitalised costs associated with the acquisition of players’ registrations spread out over the period of each player’s contract.

“A positive balance of player trading activity is the result of profits from transfers exceeding the annual amortisation of the squad. On the other hand, the more negative the final balance is, the higher the investment the club have committed to enhance their squad.”

See the full report at https://www.footballbenchmark.com/player_trading

Contact the writer of this story at moc.l1722042872labto1722042872ofdlr1722042872owedi1722042872sni@n1722042872osloh1722042872cin.l1722042872uap1722042872