February 2 – Raising money on public stock markets with a float of club shares was a popular financial tool for clubs up until the early 2000s when it went out of fashion. But how far does their on-pitch performance relate to the stock price?

KPMG’s Football Benchmark team have analysed 22 clubs listed on European stock exchanges and tracked in the Stoxx Europe Football Index.

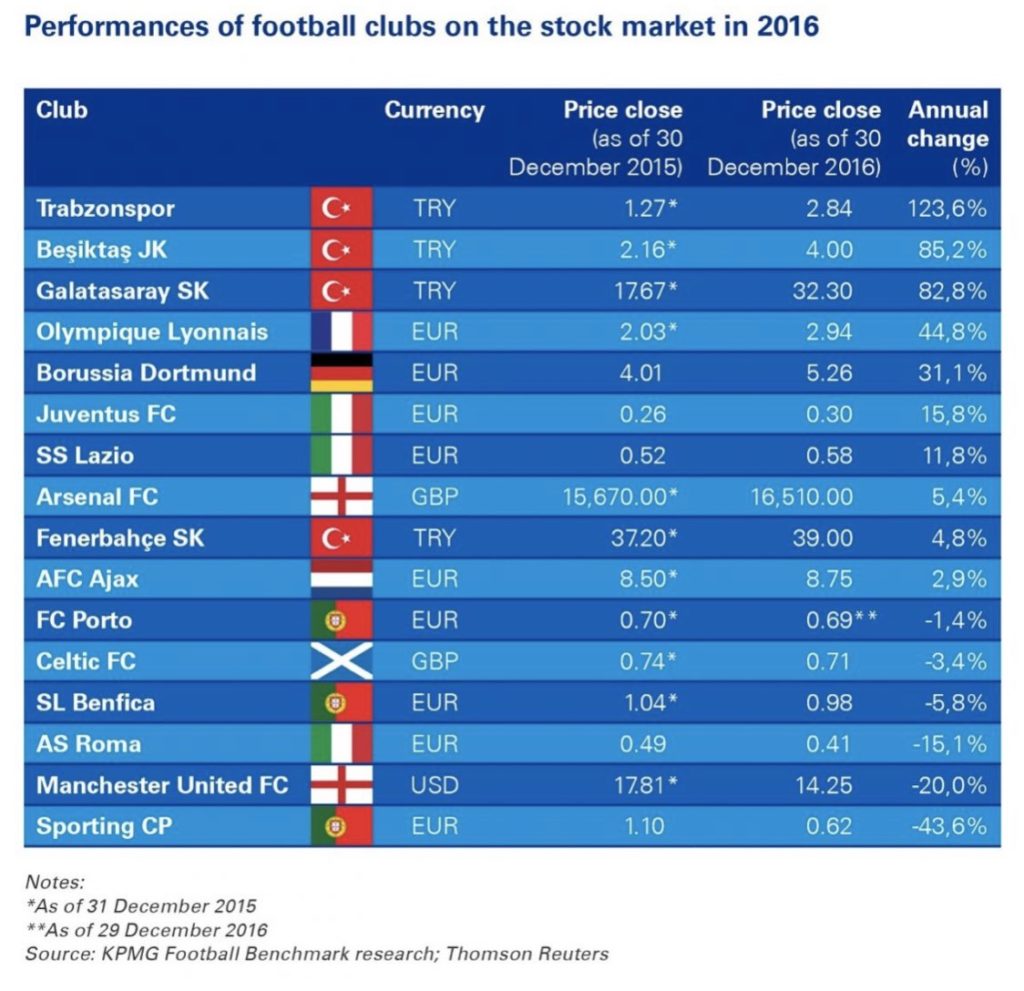

The report finds that while in some cases on-pitch performance does mirror the share price that isn’t always the case. “As an example, Juventus FC won their fifth consecutive Serie A title but also saw their stock market performance improve by 15.8%. At the other end, Manchester United, despite posting impressive revenue results, failed to qualify for the 2016/17 UEFA Champions League and experienced a 20% decrease in their share price,” said the report.

“However, SL Benfica were a good example of how there can be a lack of correlation between the on-pitch and stock market performance of a club. Indeed, despite increasing their operating revenue by 24%, winning the 2015/16 domestic title and performing well on the international stage, the Portuguese club’s share price actually fell by 5.8%.”

The report highlights three Turkish clubs – Beşiktaş JK, Galatasaray SK and Trabzonspor – as having the highest growth in share prices. Their prices seem to be driven by new sponsorship agreements, development of new infrastructure and reforms in the league governance. Fenerbahçe, who were penalised by UEFA for breaching Financial Fair Play regulations in 2015/16, saw little growth in comparison.

The report also highlights Olympique Lyonnais’ share price which “was positively impacted by key events such as the minority stake acquisition by Chinese investment fund IDG, which resulted in a 7% price rise after the announcement, and the inauguration of the club’s new stadium, the only privately-owned venue in French Ligue 1.”

Borussia Dortmund also saw a climb in share price rise 31.1% with the new broadcasting deal signed by the German Bundesliga starting in the 2017/18 season.

The report concludes that generally football clubs’ stock is stagnant and illiquid, but it is a long way from ruling out the use of the stock markets for clubs.

“As European clubs continue to grow into professionally managed global businesses, going public may be an increasingly viable consideration for various clubs,” is their conclusion.

View the report at https://www.footballbenchmark.com/stock_exchange_football_clubs

Contact the writer of this story at moc.l1714104009labto1714104009ofdlr1714104009owedi1714104009sni@n1714104009osloh1714104009cin.l1714104009uap1714104009