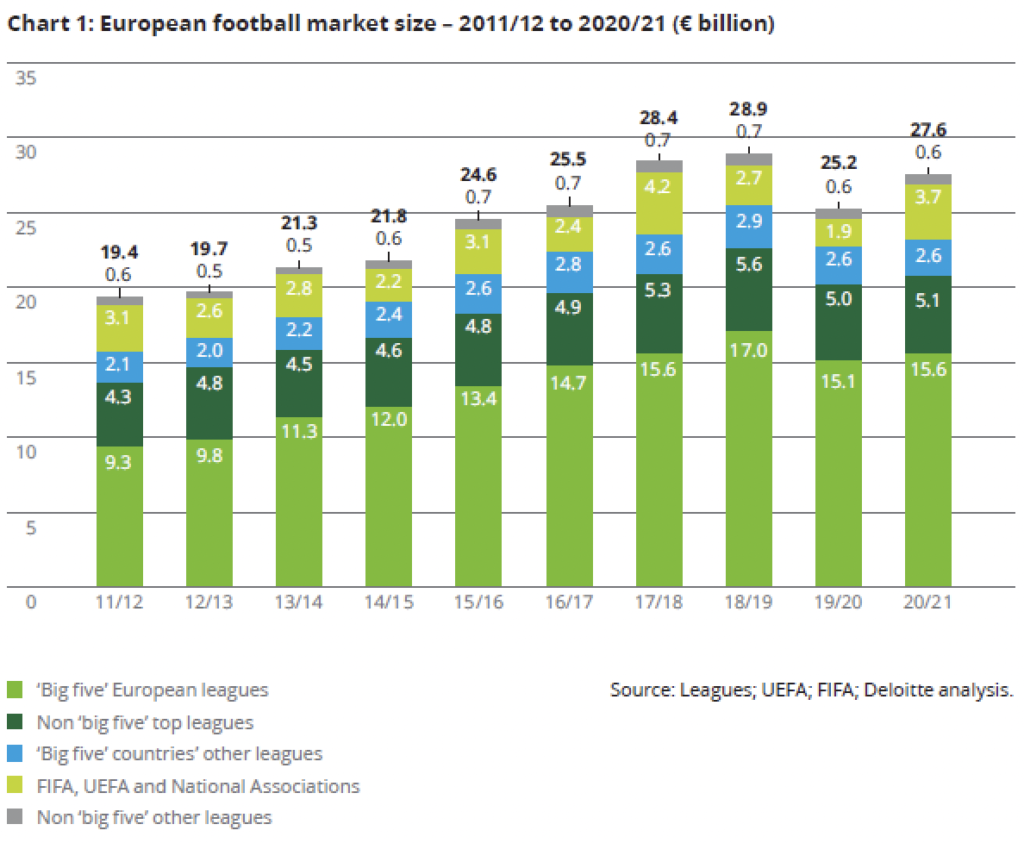

August 18 – In the dark depths of the covid pandemic football clubs were forced to lock out their fans. But even without match day revenues, the European football market grew by 10% (€2.4billion) in 2020/21 to €27.6 billion.

Deloitte’s Annual Review of Football Finance in Europe, their 31st, finds a business that seemingly can’t stop growing. The bump in revenues for 2020/21 is attributed to deferred broadcast revenues from the 2019/20 season and the success of the postponed EURO 2020 tournament, played in July 2021 in England.

The Deloitte report highlights the revenue dominance of the Big 5 European leagues who represent 57% of the European market, and whopping €15.6 billion, up 3% on the previous and further widening the poverty gap between football’s obsequious rich and its hard-pressed poor.

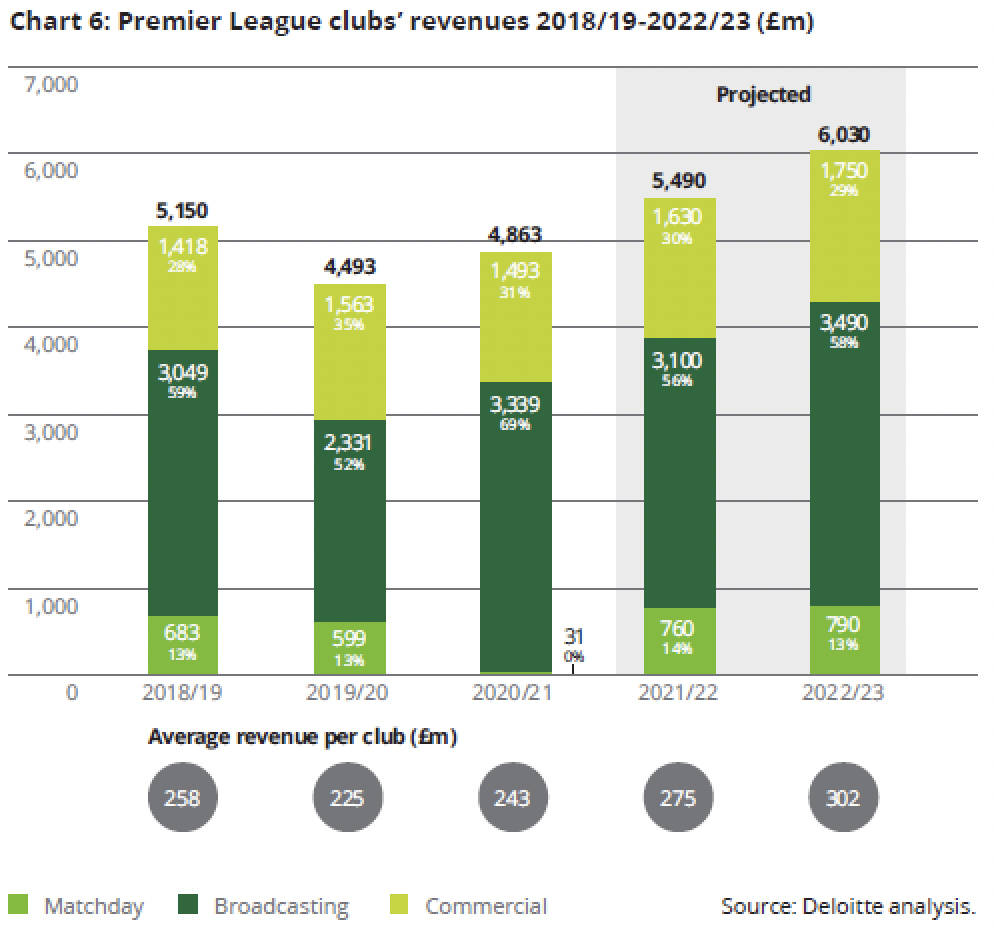

Of the big leagues, the English Premier League is still the lord of the European manor. Premier League club revenues hit £4.9 billion, up from £4.5 billion in 2019/20.

And they aren’t expected to stop there with Deloitte forecasting they will hit £5.5 billion in the 2021/22 season, and exceeding £6 billion in the 2022/23 season.

The Premier League improved total operating profits in the year from £49 million to an impressive £479 million – the only one of the ‘big five’ to increase operating profit. When excluding the Premier League the rest of the ‘big five’ leagues showed an almost doubling of total operating losses, from €461 million to €901 million.

The Bundesliga reported a 6% fall in revenue to €3 billion; La Liga also dropped 6% to €2.9 billion; Serie A grew revenue by 23% to a record high of €2.5 billion (driven by a 48% increase in broadcast revenue); while Ligue 1 grew by 1% to €1.6 billion.

Tim Bridge, lead partner in the Sports Business Group at Deloitte, said: “It’s testament to the resilience of the industry, the value driven by broadcast deals and the success of the Euros that the European football market has achieved tenacious growth, in revenue terms, over the past year.

“However, it is important not to overlook the loss-making position of many clubs. The impact of the COVID-19 pandemic fundamentally changed the financial management of European football, with leagues and clubs having to seek external investment and responding to a shift in trends around transfer spending and club operations.

Premier League revenues were driven by a broadcast rebate of £330 million which suppressed 2019/20 revenue, and the deferral of some broadcast income from the 2019/20 season into the 2020/21 financial period, report Deloitte.

Wage costs increased 5% to £3.5 billion in 2020/21, with only seven of the 17 consistent Premier League clubs reporting a reduction in wages. The Premier League’s wages/revenue ratio reduced slightly from 73% to 71% in 2020/21.

Compare this to the Championship clubs battling for a place in the Premier League. Their wage costs exceeded revenues for the fourth-consecutive year with a record high wages/revenue ratio of 125%, points out Deloitte.

While operating profits in Premier League clubs increased, pre-tax losses remained significant but decreased from £991 million to £669 million. This is the third consecutive year that Premier League clubs have reported pre-tax losses, with only four clubs reporting a pre-tax profit in 2020/21.

Overall, Premier League clubs’ net debt at the end of the 2020/21 season increased 4% to £4.1 billion (2020: £3.9 billion).

Bridge warned: “The stark reality is that the league last broke even at a pre-tax level in the 2017/18 season, highlighting the crucial need for strong governance and financial planning in the years ahead.”

Deloitte highlights a boom in investment in Big 5 league clubs with 87% of investments made by high-net-worth individuals and private equity firms, and more than two-thirds of that money coming from the US.

The report also highlights the rapid rise of multi-club ownership (MCO), with more than 70 MCOs now in the ownership business. Nine of the 20 Premier League clubs operate within a MCO model.

Sam Boor, sports M&A advisory lead in Deloitte’s Sports Business Group, said: “Football is proving an attractive opportunity for a growing pool of international investors, whose confidence has been buoyed by clubs’ recovery post-COVID. To ensure that new investment brings value to all – those on the pitch, in the stands and in the boardrooms – the importance of responsible investment, which protects the financial and operational sustainability of clubs, cannot be overemphasised.”

Contact the writer of this story at moc.l1722042645labto1722042645ofdlr1722042645owedi1722042645sni@n1722042645osloh1722042645cin.l1722042645uap1722042645