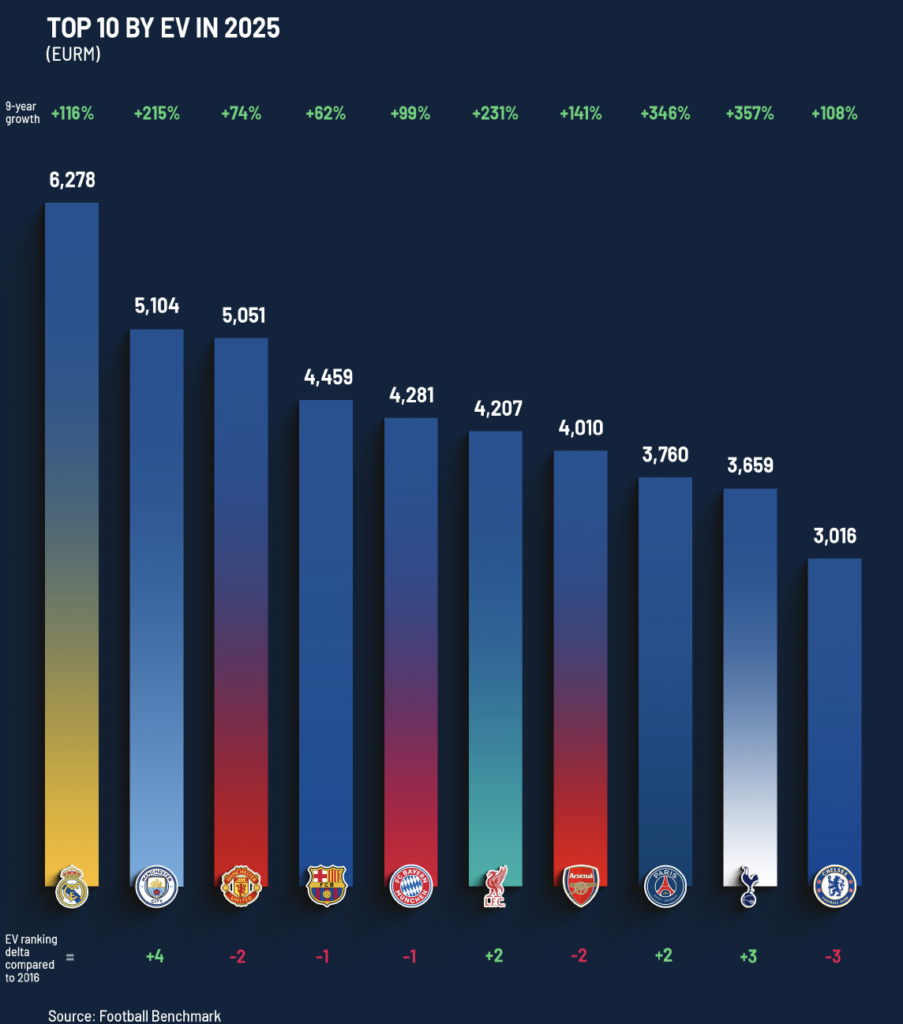

May 30 – Real Madrid may have played a season without significant silverware but they have retained their title of being the world’s most valuable football club, according to the 10th Football Benchmark Football Clubs’ Valuation: The European Elite report, with an Enterprise Value (EV) of €6.3 billion.

Another club with a poor year on the pitch but retaining a high value off it is Manchester United who are ranked third in the report with an EV of €5,051 billion, but behind their cross-town rivals Man City’s valuation of €5,104 billion. Both clubs are more than €1 billion behind Real Madrid.

The Spanish club is the first one to break the €6 billion mark. Six Premier League clubs make the top 10 by EV, with nine Premier League clubs in the elite 32 clubs that made it into the Football Benchmark analysis.

Arsenal achieved the strongest year-on-year growth, rising by 29% to reach 7th place. FC Barcelona climbed to 4th, while Chelsea FC dropped to 10th following an 8% decline.

Aston Villa showed the most significant overall growth in the ranking, up 42% year-on-year. ACF Fiorentina, PSV Eindhoven and Real Betis Balompié are all new entrants to the top 32. Only seven countries are represented in the top 32.

A total of 17 clubs have an EV of more than €1 billion. That is more than double the number of clubs breaking the €1 billion mark in 2016.

To calculate EV, Football Benchmark uses its own proprietory formula that begins with a Revenue Multiple approach that measures the value of a company relative to the revenues that it generates. It then applies five parameters – each with their own specific weight – so that the applied revenue multiplier varies from club to club.

“A total of 45 clubs from nine countries have appeared at least once in our ranking over the past 10 years. However, the 2025 edition features clubs from only seven countries, with only four representatives from outside the Big Five leagues – underscoring a growing financial polarisation within the industry. The composition of the top 10 has remained relatively stable over the past decade, with only 11 clubs rotating in and out,” said Andrea Sartori, Founder and CEO, Football Benchmark.

Football Benchmark highlight a 146% growth in the total EV of the top 32 clubs since the first report in 2016, reaching EUR 64.7 billion in 2025. “This growth has been driven by UEFA and commercial income, along with a sustained increase in transaction multiples observed across the market,” said the report authors.

“While profitability remains a challenge, with squad costs growing faster than operating revenues (78% vs. 72%), there are signs of improvement. The average squad cost-to-revenue ratio dropped from 95% in 2023 to 82% in 2025.”

The report notes that “elite clubs have cemented their status not just as sporting giants but as global commercial brands. The top 10 clubs by EV generate almost half of their revenue from commercial activities. For smaller clubs, meanwhile, financial sustainability continues to hinge on player trading strategies – a model successfully employed by the likes of SL Benfica, FC Porto and Atalanta BC.”

The composition of the top 10 has remained largely stable, with only 11 clubs rotating in and out over the 10 years.

“In the 10th edition of the Valuation Report, we focus on how European football has evolved through a decade of growth, disruption and resilience. The industry has undergone a profound transformation, shaped by regulatory reform, digitalization, the emergence of new competitions and unprecedented commercial expansion. Elite clubs are more valuable and internationally recognised than ever, yet financial sustainability remains the defining challenge ahead. As football cements its status as a global investment asset class, this report not only captures where the game stands today, but also offers a lens into the forces shaping its future,” said Sartori.

Contact the writer of this story at moc.l1750570658labto1750570658ofdlr1750570658owedi1750570658sni@n1750570658osloh1750570658cin.l1750570658uap1750570658